When it comes to the stock market, the QQQ stock price is one of the hottest topics right now and for good reason. If you're diving into the world of investing or just trying to understand how this particular stock works, you're in the right place. The QQQ stock, often referred to as the "QQQ ETF," is more than just a ticker symbol—it's a reflection of the tech-heavy Nasdaq-100 Index, which includes some of the biggest names in the tech industry. So, buckle up because we're about to break it all down for you!

Let's face it, the stock market can be intimidating, especially when you're dealing with terms like ETFs, index funds, and all that jazz. But don't worry, we're here to simplify things. The QQQ stock price isn't just a random number; it represents the performance of 100 of the largest non-financial companies listed on the Nasdaq. These aren't your run-of-the-mill companies either—they're giants like Apple, Microsoft, and Tesla, just to name a few.

Now, why should you care about the QQQ stock price? Well, if you're looking for a way to invest in the tech sector without putting all your eggs in one basket, the QQQ ETF might just be your golden ticket. It offers diversification, which is a fancy way of saying you're not putting all your money into one company. Instead, you're spreading it across a bunch of tech titans. Sounds pretty sweet, right? Let's dive deeper.

Read also:Sweet Sixteen Schedule The Ultimate Guide To March Madness Magic

What Exactly is the QQQ Stock?

Okay, let's start with the basics. The QQQ stock, or more accurately the Invesco QQQ Trust, is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. Think of it as a basket of stocks that includes 100 of the biggest and most influential companies in the tech world. When you buy shares of QQQ, you're essentially buying a piece of each of these companies. It's like getting a VIP pass to the tech industry's biggest party.

Here's the deal: the QQQ ETF isn't just about tech. Sure, it's heavily weighted towards tech companies, but it also includes companies from other sectors like consumer goods, healthcare, and even biotech. This diversification helps reduce risk, which is always a good thing when you're playing the stock market game.

Why is the QQQ Stock Price Important?

The QQQ stock price matters because it gives you a snapshot of how the tech-heavy Nasdaq-100 Index is performing. If the QQQ price is on the rise, it usually means that the companies in the index are doing well. Conversely, if the price is dropping, it could be a sign that there are some issues within the tech sector or the broader market. It's like a barometer for the health of the tech industry.

Plus, the QQQ ETF is incredibly liquid, meaning it's easy to buy and sell shares. This makes it a popular choice for both long-term investors and day traders. Whether you're looking to hold onto your shares for years or make quick trades, the QQQ ETF offers flexibility that many other investments don't.

Factors Influencing the QQQ Stock Price

There are several factors that can influence the QQQ stock price. Let's break them down:

- Economic Conditions: The overall health of the economy can have a big impact on the QQQ price. If the economy is booming, tech companies tend to do well, which can drive the price up. On the flip side, economic downturns can lead to a drop in the QQQ price.

- Company Performance: Since the QQQ ETF tracks the Nasdaq-100 Index, the performance of the companies within the index directly affects the price. If a major company like Apple reports a bad quarter, it could drag down the entire index.

- Interest Rates: Changes in interest rates can also impact the QQQ price. Higher interest rates can make borrowing more expensive for companies, which can negatively affect their stock prices.

- Market Sentiment: Sometimes, the QQQ price can be influenced by how investors feel about the market in general. If there's a lot of uncertainty or fear, investors might sell off their shares, causing the price to drop.

How to Analyze the QQQ Stock Price

So, you want to analyze the QQQ stock price? Great! Here are a few methods you can use:

Read also:The 100000 Pyramid Unlocking Secrets And Building Wealth

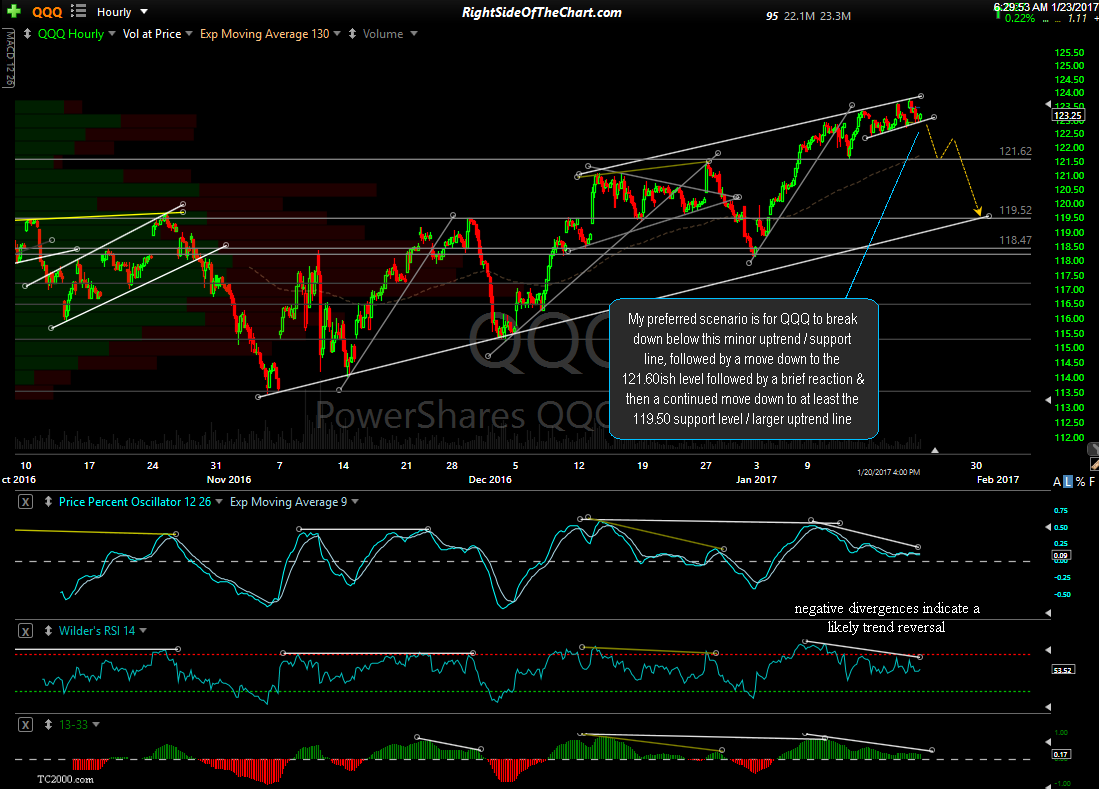

Technical Analysis

Technical analysis involves looking at charts and patterns to predict future price movements. Traders often use indicators like moving averages and relative strength index (RSI) to identify trends and potential buy/sell signals. It's like reading tea leaves, but with numbers.

Fundamental Analysis

Fundamental analysis focuses on the underlying value of the companies within the QQQ ETF. This involves looking at financial statements, earnings reports, and other key metrics to determine whether the price is overvalued or undervalued. It's a bit like being a detective, but with spreadsheets.

Historical Performance of the QQQ Stock Price

Let's take a trip down memory lane and look at how the QQQ stock price has performed over the years. Since its inception in 1999, the QQQ ETF has seen its fair share of ups and downs. It started off strong during the dot-com boom, but like many tech stocks, it took a hit during the bust. However, it's since recovered and has been on a steady upward trajectory, especially in recent years.

Here are some key milestones:

- 2000s: The QQQ ETF was heavily affected by the dot-com bubble burst, but it managed to survive and recover.

- 2010s: This decade was a golden era for tech stocks, and the QQQ ETF saw significant growth, driven by companies like Apple and Google.

- 2020s: Despite the challenges posed by the pandemic, the QQQ ETF continued to perform well, thanks to the resilience of tech companies.

QQQ Stock Price vs. Other ETFs

How does the QQQ stock price stack up against other ETFs? Well, it's important to note that the QQQ ETF is unique in its focus on the tech-heavy Nasdaq-100 Index. While other ETFs might track broader indices like the S&P 500, the QQQ ETF offers a more concentrated exposure to the tech sector. This can be both a pro and a con, depending on your investment goals.

For example, if you're bullish on tech, the QQQ ETF might be your best bet. But if you're looking for a more diversified portfolio, you might want to consider other ETFs that offer broader exposure.

Investing in QQQ: Is It Right for You?

Now that you know a bit more about the QQQ stock price, you might be wondering if it's the right investment for you. Here are a few things to consider:

- Risk Tolerance: The QQQ ETF can be volatile, especially in times of market uncertainty. If you're not comfortable with potential price swings, you might want to think twice.

- Investment Goals: Are you looking for long-term growth or short-term gains? The QQQ ETF can cater to both, but it's important to align it with your goals.

- Diversification: While the QQQ ETF offers some diversification within the tech sector, it's still heavily weighted towards a few large companies. Make sure it fits into your overall investment strategy.

Common Misconceptions About the QQQ Stock Price

There are a few misconceptions about the QQQ stock price that we need to clear up:

It's Only for Tech Enthusiasts

While the QQQ ETF is heavily focused on tech, it's not just for tech enthusiasts. Anyone looking to gain exposure to the tech sector can benefit from investing in QQQ. Plus, the inclusion of companies from other sectors adds an extra layer of diversification.

It's Too Risky

Yes, the QQQ ETF can be volatile, but that doesn't mean it's too risky. Like any investment, it comes with its own set of risks and rewards. As long as you do your research and understand what you're getting into, you can make informed decisions.

Expert Tips for Maximizing Your QQQ Investment

Here are a few tips to help you get the most out of your QQQ investment:

- Stay Informed: Keep up with the latest news and trends in the tech industry. This will help you make better-informed decisions about when to buy or sell.

- Dollar-Cost Averaging: Instead of trying to time the market, consider using dollar-cost averaging to gradually invest in QQQ over time. This can help reduce the impact of market volatility.

- Reinvest Dividends: The QQQ ETF pays dividends, so consider reinvesting them to boost your returns over time.

Conclusion

So, there you have it—a comprehensive guide to understanding the QQQ stock price. Whether you're a seasoned investor or just starting out, the QQQ ETF offers a unique opportunity to tap into the tech sector. Just remember to do your homework, stay informed, and invest wisely.

Now, here's the fun part. If you've found this article helpful, we'd love to hear from you! Drop a comment below and let us know what you think. And if you're feeling generous, why not share this article with your friends? Who knows, you might just help them make smarter investment decisions. Happy investing, folks!

Table of Contents

- What Exactly is the QQQ Stock?

- Why is the QQQ Stock Price Important?

- Factors Influencing the QQQ Stock Price

- How to Analyze the QQQ Stock Price

- Historical Performance of the QQQ Stock Price

- QQQ Stock Price vs. Other ETFs

- Investing in QQQ: Is It Right for You?

- Common Misconceptions About the QQQ Stock Price

- Expert Tips for Maximizing Your QQQ Investment

- Conclusion