Ever wondered why Tesla's stock price keeps yo-yoing like a rollercoaster? Well, buckle up because we’re diving deep into the world of Tesla’s stock, where every day feels like a new episode of financial drama. Whether you're a seasoned investor or just someone curious about the tech giant reshaping the automotive industry, this article has got you covered. We’ll break down what's driving Tesla’s stock price right now and why it matters to you.

Tesla's stock price is not just about numbers on a screen; it’s a reflection of the broader market sentiment, investor confidence, and, of course, Elon Musk's latest tweet. In today's fast-paced world, understanding the factors influencing Tesla's stock price can make or break your investment strategy. So, if you’re ready to untangle the web of finance, let’s get started!

This ain't just another stock analysis piece. We’re going full-throttle into the nitty-gritty of Tesla's financial journey, from the macroeconomic factors to the micro-details that make or break its stock value. Think of it as a roadmap to help you navigate the stock market like a pro.

Read also:Jason Richardson The Highflying Journey Of A Slam Dunk Legend

Here's a quick table of contents to guide you through the chaos:

- Tesla's Stock Price: The Big Picture

- Macroeconomic Factors Shaping Tesla's Stock

- Company-Specific Factors Driving Tesla's Price

- Market Sentiment and Investor Behavior

- Innovation and Product Launches

- Regulatory Changes and Global Policies

- Competition in the Electric Vehicle Market

- Tesla's Financial Health and Performance

- Elon Musk: The X-Factor in Tesla's Stock

- What’s Next for Tesla's Stock Price?

Tesla's Stock Price: The Big Picture

Before we dive into the specifics, let’s zoom out and look at the bigger picture. Tesla’s stock price is influenced by a wide array of factors, ranging from global economic trends to Elon Musk's late-night antics. It’s like a perfect storm of variables, each with its own weight and significance.

For starters, Tesla's stock price today reflects the company's position as a leader in the electric vehicle (EV) market. With competitors nipping at its heels and new entrants trying to carve out a piece of the pie, Tesla’s ability to innovate and adapt is crucial. But it’s not just about the cars; Tesla’s stock is also driven by its energy solutions, autonomous driving tech, and even its sustainability initiatives.

Now, let’s break this down into smaller chunks:

- Tesla's stock is heavily influenced by investor sentiment, which can swing wildly based on news, earnings reports, and even social media buzz.

- Global economic conditions, such as interest rates and inflation, play a significant role in shaping Tesla's stock performance.

- Elon Musk’s influence on Tesla's stock cannot be overstated. His tweets, public appearances, and sometimes controversial behavior can send the stock soaring—or crashing—overnight.

Key Stats About Tesla's Stock

Here’s a quick rundown of some key stats that paint a clearer picture:

- Tesla's market capitalization is currently hovering around $800 billion, making it one of the most valuable companies in the world.

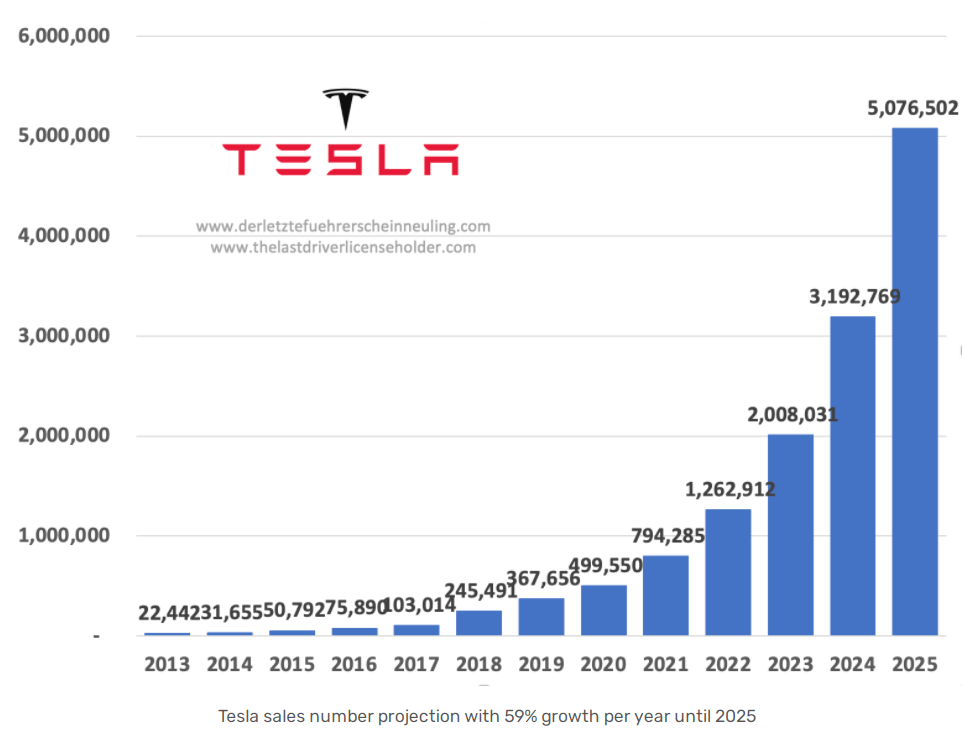

- In 2022 alone, Tesla delivered over 1.3 million vehicles globally, marking a significant milestone in its journey to dominate the EV market.

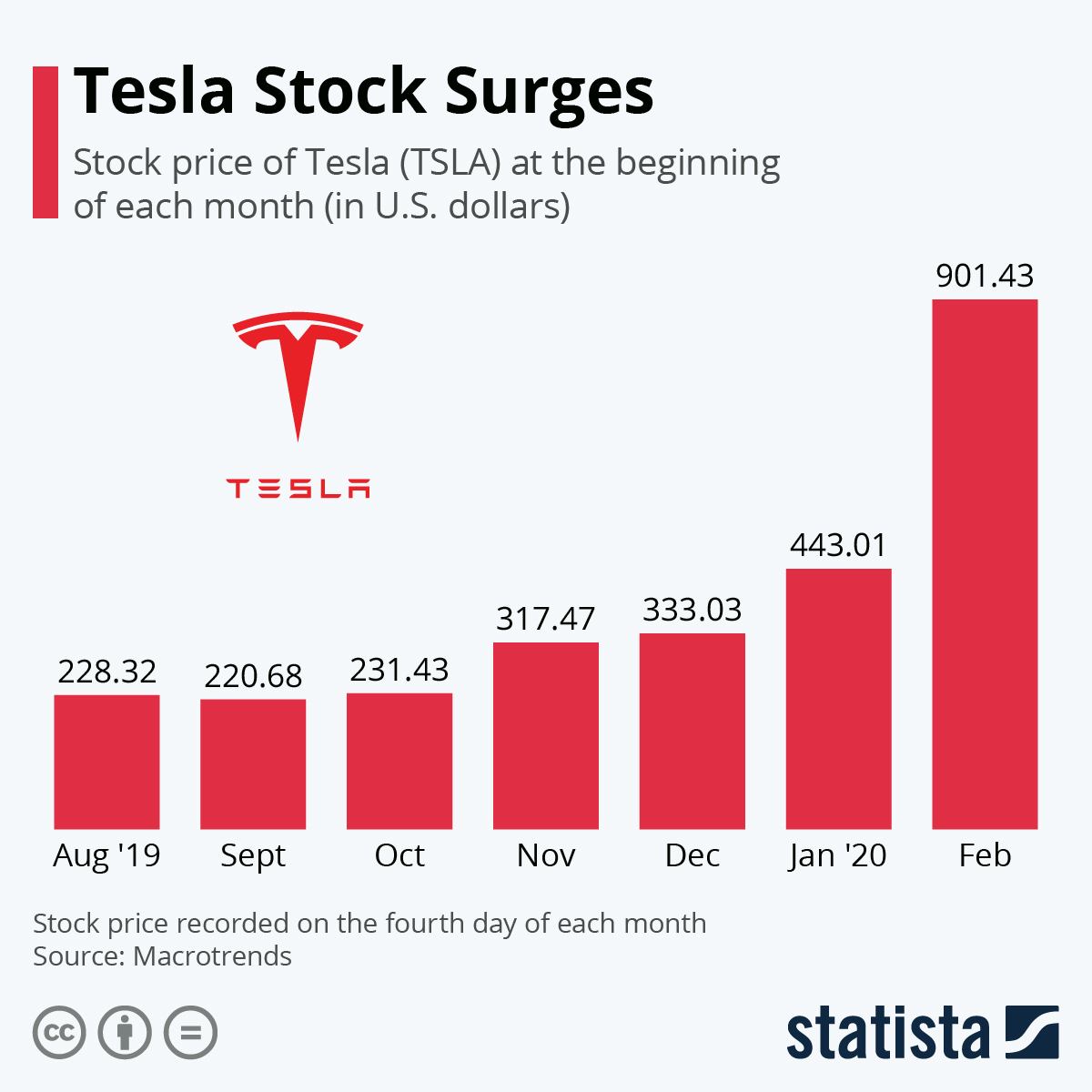

- Despite its massive success, Tesla’s stock has seen its fair share of volatility, with fluctuations often tied to macroeconomic factors and Elon Musk's personal brand.

Macroeconomic Factors Shaping Tesla's Stock

When it comes to Tesla's stock price, you can’t ignore the macroeconomic factors at play. These are the big-picture elements that influence not just Tesla but the entire stock market. Think of them as the tides that can either lift or sink a ship.

Read also:United Pilot Attacked The Inside Story Of Turbulence Beyond Altitude

Interest Rates and Inflation

Interest rates set by central banks have a direct impact on Tesla's stock price. When rates go up, borrowing becomes more expensive, which can slow down consumer spending and corporate investments. For Tesla, this means fewer people buying cars or investing in its energy solutions.

On the flip side, inflation also plays a role. If prices for raw materials like lithium and cobalt rise, Tesla’s production costs increase, squeezing its profit margins. This can lead to a drop in investor confidence and, consequently, a dip in the stock price.

Global Economic Conditions

Beyond interest rates and inflation, broader economic conditions also matter. For instance, if the global economy slows down, demand for luxury goods like Tesla cars might decline. Conversely, during periods of economic growth, Tesla could see a surge in sales as more people look to upgrade to electric vehicles.

Let’s not forget about exchange rates. Since Tesla operates globally, fluctuations in currency values can impact its revenues and expenses. A stronger dollar, for example, might make Tesla’s products more expensive for international buyers, affecting sales in key markets like Europe and Asia.

Company-Specific Factors Driving Tesla's Price

While macroeconomic factors set the stage, company-specific elements are the real stars of the show. These are the internal dynamics that make Tesla tick—or in some cases, hiccup.

Revenue and Profitability

Tesla's financial performance is a major driver of its stock price. Strong revenue growth and improving profitability tend to boost investor confidence, pushing the stock higher. In recent quarters, Tesla has reported impressive earnings, thanks in part to its expanding production capacity and cost-cutting measures.

However, Tesla’s profitability isn’t just about selling cars. Its energy business, including solar panels and battery storage systems, contributes significantly to the bottom line. Investors are also keeping a close eye on Tesla’s autonomous driving technology, which could unlock massive value in the future.

Supply Chain Challenges

Supply chain issues have been a thorn in Tesla’s side for years. From chip shortages to delays in securing raw materials, these challenges can disrupt production and delay deliveries. When this happens, it can negatively impact Tesla’s stock price as investors worry about its ability to meet demand.

That said, Tesla has shown remarkable resilience in navigating these challenges. Its vertical integration strategy, where it produces many components in-house, has helped mitigate some of the risks. But as the EV market grows, so does the competition for resources, making supply chain management even more critical.

Market Sentiment and Investor Behavior

Market sentiment is like the mood of the stock market, and it can swing wildly based on news, rumors, and even social media trends. Tesla’s stock is particularly sensitive to these shifts, thanks in large part to Elon Musk’s outsized influence.

The Power of Social Media

Elon Musk’s Twitter presence has been both a blessing and a curse for Tesla’s stock. On one hand, his tweets can generate buzz and drive interest in Tesla’s products. On the other hand, they can also spark controversy and volatility. Remember that time he tweeted about taking Tesla private? Chaos ensued.

But it’s not just Musk’s tweets that matter. Social media platforms like Reddit and Twitter have become hotbeds for investor discussions, where trends and rumors can quickly gain traction. For Tesla, this means its stock price can be swayed by grassroots movements or even memes.

Risk Tolerance and Speculation

Investor behavior also plays a key role. Tesla’s stock attracts a mix of long-term investors and speculative traders, each with different risk tolerances and strategies. This can lead to wild swings in the stock price as different groups react to news and data in their own ways.

For example, when Tesla reports strong earnings, long-term investors might see it as a sign of stability and growth. Speculative traders, on the other hand, might see it as an opportunity to cash in quickly. This dynamic can create volatility, making Tesla’s stock both exciting and unpredictable.

Innovation and Product Launches

Innovation is at the heart of Tesla’s success, and its ability to launch groundbreaking products keeps investors on the edge of their seats. From the Model S to the Cybertruck, Tesla has a knack for creating buzz and setting trends in the EV market.

New Product Announcements

Every time Tesla announces a new product, its stock price tends to spike. Investors see these announcements as a sign of the company’s continued growth and innovation. Take the Cybertruck, for example. Its futuristic design and unique features generated massive interest, driving Tesla’s stock higher even before the truck hit the market.

But it’s not just about the cars. Tesla’s energy products, such as the Powerwall and Solar Roof, are also key drivers of its stock price. As more consumers adopt renewable energy solutions, Tesla stands to benefit significantly.

Autonomous Driving Technology

Perhaps the most exciting—and controversial—area of innovation for Tesla is autonomous driving. The company’s Full Self-Driving (FSD) software has been a major talking point, with both fans and critics weighing in on its potential. If Tesla can successfully roll out FSD and gain regulatory approval, it could unlock massive value for shareholders.

However, the road to autonomous driving is fraught with challenges, including regulatory hurdles and public skepticism. Tesla’s ability to navigate these challenges will be crucial in determining the long-term impact on its stock price.

Regulatory Changes and Global Policies

Regulatory changes and global policies are another critical factor influencing Tesla’s stock price. As the EV market grows, governments around the world are implementing policies to encourage adoption and reduce carbon emissions.

Tax Incentives and Subsidies

Tesla benefits significantly from tax incentives and subsidies offered by governments to promote EV adoption. These incentives lower the cost of Tesla vehicles for consumers, making them more attractive. However, changes in these policies can have a direct impact on Tesla’s sales and, consequently, its stock price.

For example, if the U.S. government reduces or eliminates tax credits for EVs, it could dampen demand for Tesla’s products. Similarly, if European regulators impose stricter emissions standards, Tesla might need to adjust its production processes, potentially affecting its margins.

Trade Policies and Tariffs

Trade policies and tariffs also play a role. Tesla operates globally, and any disruptions in international trade can affect its supply chain and profitability. For instance, tariffs on Chinese imports have impacted Tesla’s production costs, leading to fluctuations in its stock price.

As global trade dynamics continue to evolve, Tesla will need to adapt to new regulations and negotiate favorable terms with its suppliers. This ability to navigate the complexities of global trade will be key to maintaining its stock price in the long run.

Competition in the Electric Vehicle Market

Competition is heating up in the EV market, and Tesla isn’t the only player in town anymore. With traditional automakers like Ford and GM ramping up their EV offerings, and new entrants like Rivian and Lucid Motors making waves, Tesla faces increasing pressure to stay ahead.

Market Share and Brand Loyalty

Tesla’s market share is still significant, but it’s being challenged by competitors offering similar or even better products at lower prices. Maintaining brand loyalty in this competitive landscape will be crucial for Tesla’s long-term success. Investors are watching closely to see how Tesla responds to these threats.

That said, Tesla’s first-mover advantage and strong brand recognition give it a leg up in the market. Its ability to innovate and deliver cutting-edge products continues to set it apart from the competition.

Partnerships and Collaborations

To stay competitive, Tesla is also exploring partnerships and collaborations. For example, its deal with Hertz to supply EVs for rental fleets has generated significant interest and boosted its stock price. These strategic moves help Tesla expand its reach and tap into new markets, mitigating some of the risks posed by competition.

Tesla's Financial Health and Performance

Tesla’s financial health is a key indicator of its stock price. Strong earnings, healthy cash flow, and a solid balance sheet give investors confidence in the company’s ability to weather market volatility.

Earnings Reports and Guidance

Tesla’s quarterly earnings reports are always a big deal. They provide a snapshot of the company’s financial performance and offer guidance for the future. When Tesla beats expectations, its stock tends to soar. Conversely, if it misses the mark, the stock can take a hit.

Investors also pay close attention to Tesla’s guidance, which outlines its plans and projections for the coming quarters. Clear and achievable goals can reassure